Diabetes is a silent epidemic in Malaysia, affecting 1 in 6 adults, according to a survey by Malaysia’s Ministry of Health. In fact, many individuals are unaware they have the disease, making it a hidden health crisis. Malaysia now ranks among countries with the highest diabetes rates worldwide.

Adding to the concern is a shift in demographics: diabetes is no longer an illness primarily affecting older adults. In these past years, an increasing number of young people in their teens and 20s are being diagnosed, leading to lifelong challenges.

“With people getting diabetes at a much younger age – during their late teens and early 20s – it means they must live with the disease for a much longer period of their life, resulting in more complications and a lower quality of life,” highlighted Dr Ikram Ismail, President of Diabetes Malaysia, in CNA.

Recognising the severity of this issue, the government has proactively addressed the rising diabetes rates by implementing a tax on one of the primary contributors to the condition: sugar.

Sickeningly Sweet: The Dangers of Sugar

Sugar is seen as a major culprit in the development of serious health risks, particularly if you regularly have more of it than what is recommended. It is a significant driver of Type 2 diabetes, the most common form of the disease.

“High sugar intake leads to obesity as it has calories and that is the main problem. Once you are obese, it is likely to develop into diabetes,” elaborated Dr Rosnawati Yahya, Consultant Nephrologist and Kidney Transplantation Physician at Sunway Medical Centre, Sunway City, in Sinar Daily.

“(You can also develop) hypertension, hyperlipidaemia, fatty liver, and breathing issues as they are all interrelated,”

While genetics can play a role, poor dietary habits – like consuming excessive sugary drinks – are often to blame.

Consuming excessive amounts of sugary foods and beverages can spike our blood sugar levels. This causes the pancreas to release insulin, a hormone that helps cells absorb glucose. The constant demand for insulin production can, over time, result in insulin resistance, where the cells in our body stop responding to insulin properly.

This disrupts the balance of blood sugar levels and can eventually lead to diabetes, specifically Type 2 diabetes.

This is where the sugar tax makes its stand.

Fighting Back With The Sugar Tax

In 2019, Malaysia introduced a sugar tax targeting sugar-sweetened beverages (SSBs). The tax started at RM0.40 per liter, increased to RM0.50 in 2024, and will rise to RM0.90 in 2025.

How does this affect prices?

To calculate the tax for a 330ml can of Coca-Cola

New tax per litre in 2025: RM0.90

Tax for 330ml: 0.33 litre × RM0.90 = RM0.297 (about RM0.30)

(Source: MalayMail)

The goal? To discourage Malaysians from consuming sugary drinks while promoting healthier choices.

The tax appears to be working. A recent study revealed a 9.25% reduction in sugar consumption since the tax’s introduction, marking an essential step toward combating diabetes.

Malaysia is just one of the many countries, including the Philippines, Thailand, Vietnam and Indonesia, who have introduced this tax, since the World Health Organization (WHO) urged it to be added to national policies in efforts to combat obesity and its resulting health consequences globally.

As Dr Rudiger Krech, Director for Health Promotion at WHO, explained in The Straits Times: “Taxing unhealthy products creates healthier populations. It has a positive ripple effect across society – less disease and debilitation, and revenue for governments to provide public services.”

Why Not Every Country Has a Sugar Tax

While Malaysia’s sugar tax has shown success, not all countries have taken the same path. One example is neighbouring Singapore, which is waging its own war against diabetes.

“We have been very reluctant to look into a tax like that. The principle is not wrong – that sin tax is a policy of this Government,” said Mr Ong Ye Kung, Minister for Health in Singapore.

The Singapore government believes that common commodities like sugar should be treated differently from other health-compromising products, such as cigarettes and alcohol.

Mr Ong postulated: “Assume you extend it further. You can also tax salt, for example, or oil.”

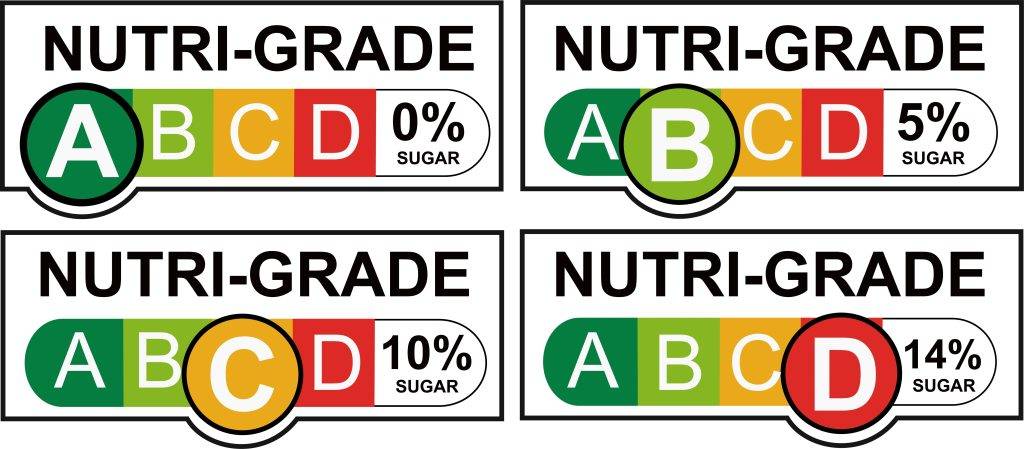

As such, Singapore is focused on promoting healthier eating habits through its Nutri-Grade labelling system. It grades packaged food and drinks based on its sugar and saturated fat content. This important nutritional information helps buyers make more mindful purchases. This system empowers consumers to make healthier choices without punitive measures.

Read more: Nutri-Grade Measures in Singapore Effective End Dec 2023

Employing a More Holistic Strategy

Overall, while Malaysia’s sugar tax is a positive step, more action is required to tackle the root causes of diabetes within the country. This includes greater focus on providing incentives for healthier alternatives from a producer’s point, and increasing public awareness and education.

By taking a multifaceted approach to addressing public health concerns related to sugar consumption, Malaysia can aim to achieve long-term behavioural changes and curb the rising tide of this disease.